Why Venture Capital Matters More Than You Think and How It Impacts You

A journalistic exploration into how VC quietly shapes your daily life.

Lately, I’ve been getting this question a lot: So..what exactly is ‘Venture Capital’?

Every time I mention my work in or around the VC ecosystem, I’m met with a mix of intrigue, confusion and sometimes, complete bafflement. As if it’s some secret society or financial black hole.

But honestly? It’s not that complicated.

Venture Capital is just another form of capital only structured differently and built for risk. It lives in the private markets. It thrives on bold bets. And it plays a crucial role in shaping the startups and tools we use every day.

Other closely related terms? Think: Private Equity, Angel Capital, Convertible Debt, Venture Debt - all branches on the same tree of private market investing.

However, not all startups take this path, quite a few of them are bootstrapped by choice. I’ve had the chance to work with all kinds of founders - VC-backed and bootstrapped alike supporting them in taking their ideas to market and scaling thoughtfully.

So I figured: Why not write an introductory post?

Something that clarifies the fundamentals, explains what VC really is and more importantly, why it matters.

Whether you’re an aspiring founder, a curious creative, or someone who just likes understanding how the world works this one’s for you.

Oh and… when you do end up building something amazing someday (which I believe you will), feel free to reach out. If I can support with insights, intros, funding avenues, I’d be more than happy to.

So, let’s start with a simple question:

👉 What is Venture Capital and why does it shape so much more of your life than you think?

Imagine trying to build the next Apple, Google or OpenAI - bold ideas, with wild ambition, zero profits and a ton of risk.

Now ask yourself:

Who would fund that?

Not a bank. Not a government grant.

This is where Venture Capital (VC) steps in, the capital of risk, vision and asymmetric bets.

Venture capital is money invested in early-stage companies that have high growth potential but also high risk. It’s how transformational ideas get the runway to become real.

- Y Combinator Startup Library

At its core, venture capital is a specialized form of private equity focused specifically on funding high-risk, high-reward innovation. It channels money typically from institutional investors, angels, family offices and high-net-worth individuals (in the VC ecosystem referred to as Limited Partners) into early-stage, high-potential startups that most traditional investors would find too risky.

But VC is more than just capital.

It’s a belief system.

A method of funding the future before it's obvious.

Venture capital is not about spreadsheets. It’s about people, uncertainty, and the courage to fund a future that doesn’t exist yet.

- VC Lab, Founder Institute

It’s how the smartphone came into your pocket.

How Uber redefined mobility.

How Stripe powers global commerce.

How DoorDash delivers convenience.

And how ChatGPT landed on your screen.

“Venture capital is not just funding it’s fuel for boldness.”

- Adapted from Y Combinator & Ilya Strebulaev (Stanford GSB)

In this piece, we’ll explore five reasons why venture capital matters more than you think and how it quietly shapes your world, your economy, and the tools you use every day.

1. Venture Capital Funds Bold Ideas (before the World discovers them)

Traditional banks don’t like risk. Governments move slowly. Public markets demand predictable returns. But the most transformative ideas say a smartphone with no buttons ? Strangers renting out their homes to travelers ? or Generative AI models like ChatGPT begin life as bets most institutions would never take.

These ideas need time, talent, and belief before they become products that change the world. Sometimes they fail (lots of them do, infact only a miniscule percentage survives in the long-term). But when they succeed, they deliver breakthrough innovations and often, exceptional returns. This is what drives the VC industry.

“Venture capital is about investing in uncertainty and dreaming beyond the numbers.”

— Ilya Strebulaev, Stanford Professor & Author of The Venture Mindset

According to research from Stanford's Ilya Strebulaev and Will Gornall:

42% of all U.S. public companies founded since 1979 were backed by VC including Apple, Intel, Google, and Amazon.

Look at this insightful post

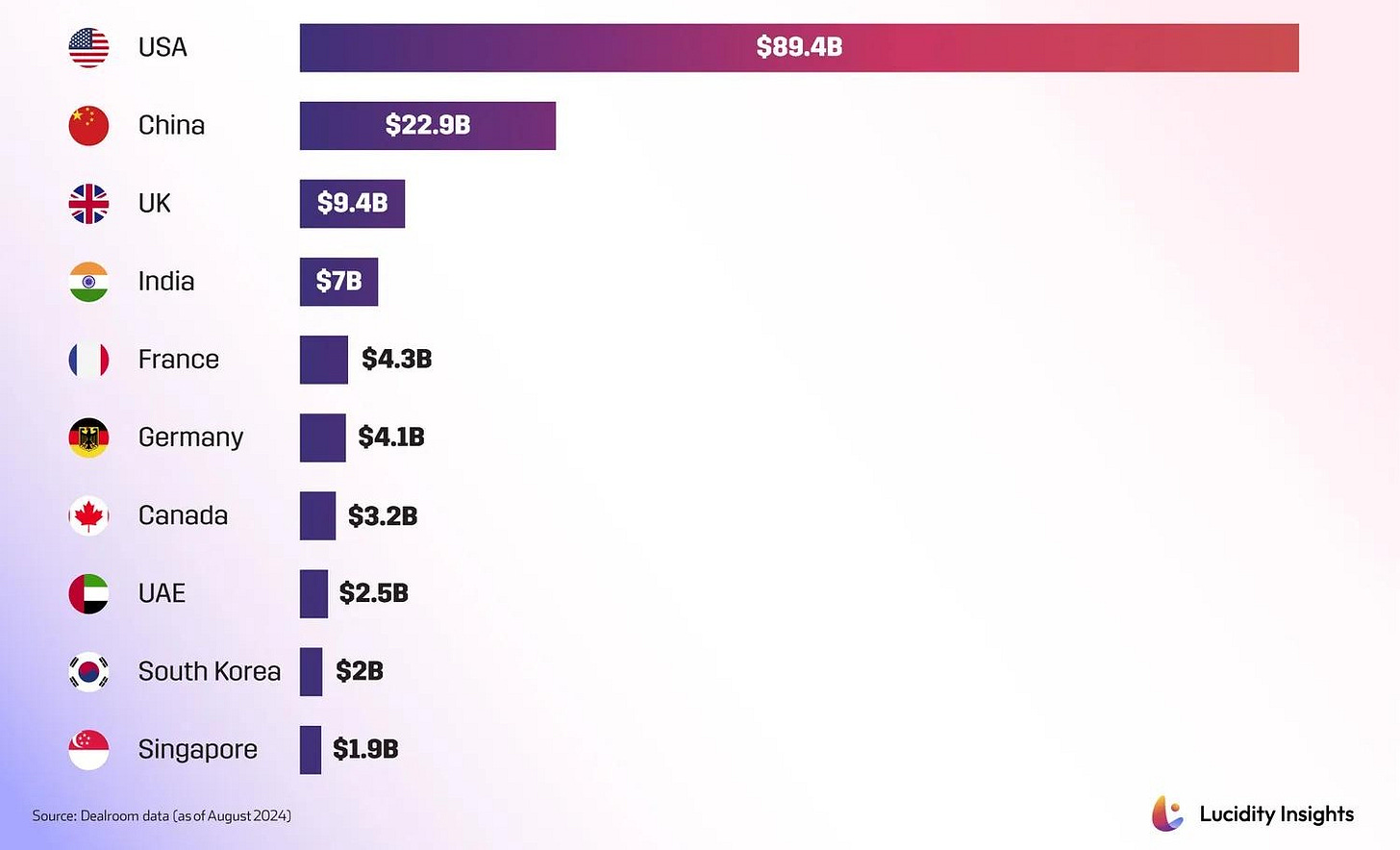

Put simply, the backbone of the modern economy is built on venture-backed innovation designing the fabric of our digital lives. The next wave of those game-changers are being funded today quietly and often against all odds. In 2025 alone, global VC investments are projected to exceed $750 billion.

2. Venture Capital Embraces Failure - Because it bets on Outliers

Startups fail. A lot. But failure is not bad, it’s just work-in-progress. The greatest learnings often succeed it.

In fact, research consistently shows that about 9 out of 10 startups don’t make it. Venture capital isn’t designed to avoid failure, it’s designed to absorb it. Because behind the chaos is a strategy that rewards the outliers.

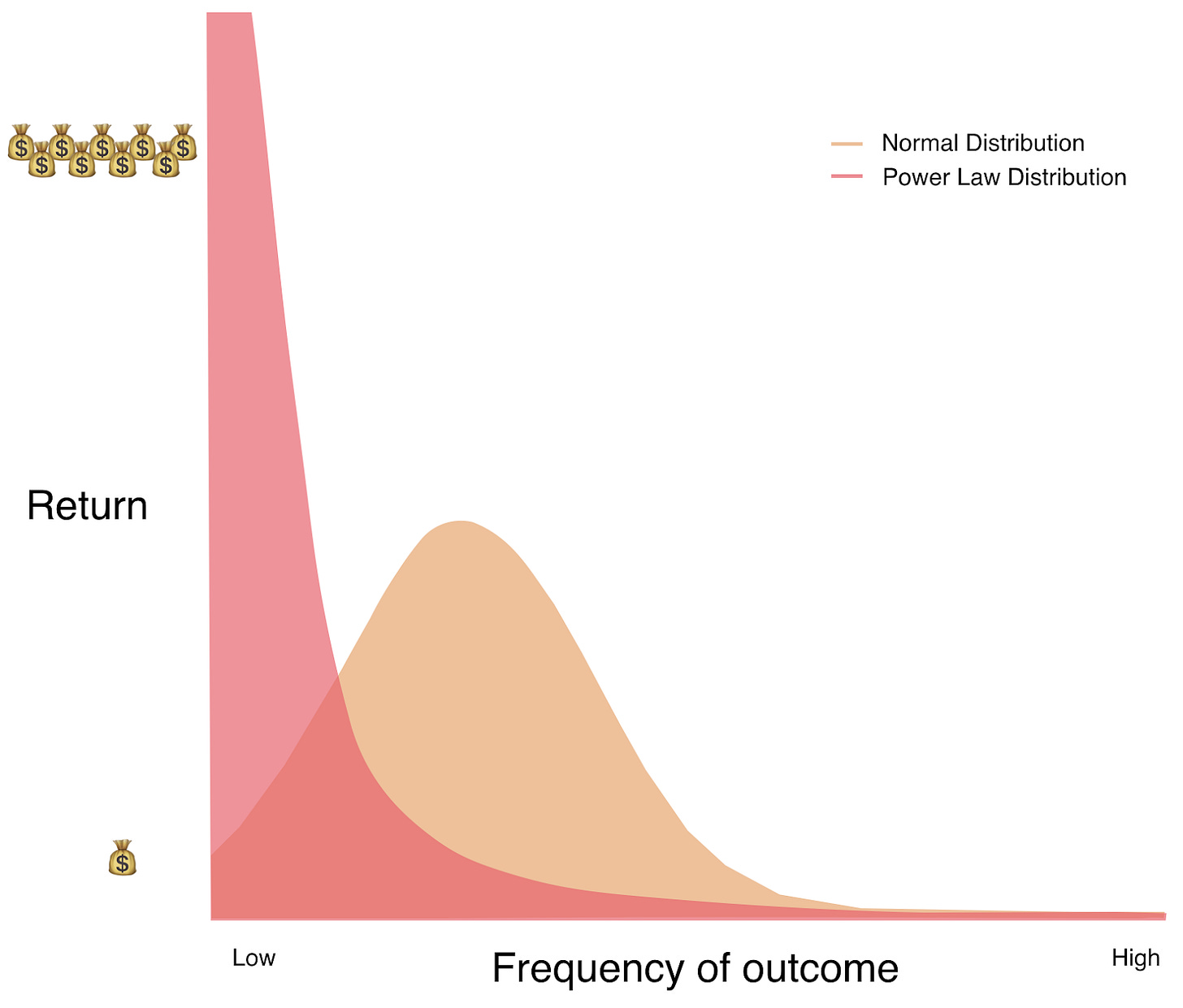

At the heart of this model is the Power Law - the idea that just one or two investments will generate the vast majority of returns. This is a cousin of the Pareto Principle, where 20% of the effort leads to 80% of the results. And also in Life, its not about counting failures but learning from unexpected events, embracing and focusing on winning the next move.

In VC, it's even sharper: 1 in 10 investments may succeed, but the one that does could define a generation.

“Out of ten bets, nine may fail. But the tenth could change the world.”

— Marc Andreessen, Co-founder, Andreessen Horowitz (a16z)

The most legendary VC firms including Sequoia, Benchmark, a16z have backed category-defining companies and made plenty of missteps. What separates them isn’t perfection. It’s their ability to learn fast, stay curious, and keep swinging. You can grab the most distinguished title on this topic here: The Power Law by Sebastian Mallaby.

Unlike traditional lenders who demand stability and collateral, VCs know that the greatest ideas often look irrational at first. So they fund experimentation. They give failure a home as long as the learnings are real.

🚀 A world without VC is a world with fewer moonshots.

And moonshots are how we got smartphones, clean energy and even this very platform you're reading on. Substack has raised multiple rounds of funding including a substantial Series B led by Andrew Chen of VC firm Andreessen Horowitz.

3. Venture Capital Accelerates the Future

Imagine a world without Google Maps, Netflix or WhatsApp.

No Zoom calls that connected us during a global pandemic.

Venture capital has a way to accelerate invention. It turns blurry sketches on napkins into technologies that redefine how we live, work, study and communicate.

“Venture capital is a time machine - it brings the future forward.”

— Scott Kupor, Managing Partner at a16z

Here's what that looks like in real life:

Google was born out of a Stanford PhD thesis. It got its first $100,000 in seed funding from Andy Bechtolsheim, later Google secured a $25 million round of funding from venture capital firms like Kleiner Perkins Caufield & Byers and Sequoia Capital. This initial VC funding helped Google grow and eventually led to its successful initial public offering (IPO) in 2004.

Airbnb was dismissed as a bizarre idea - strangers sleeping in other people’s homes? VC believed when no one else did. Today it has over 150 million users and has completely changed travel.

Stripe, a fintech infrastructure company you may never think about, powers millions of online businesses globally. It was funded by Sequoia Capital when its founders were just teenagers.

These aren’t isolated success stories. They represent a system that takes high-risk ideas, funds them when traditional capital won’t, and gives them the tools to move faster than the world expects.

According to Stanford’s Ilya Strebulaev, over 40% of all U.S. public companies founded since 1979 were VC-backed. These companies account for 80% of U.S. public market capitalization as of 2024.

(Source: “The Economic Impact of Venture Capital” – Stanford GSB Research)

In short: VC doesn’t just chase returns. It funds revolutions.

Whether you realize it or not, many of the tools, services and technologies you use every day exist because someone, somewhere, took a bet when it seemed premature. That’s the hidden but powerful ripple effect of venture capital.

4. VC Is a Full-Stack Partnership goes beyond funding

Behind every successful startup isn’t just capital, there’s capability.

What makes venture capital different isn’t just money, it’s the depth of partnership that comes with it.

“We weren’t just looking for money. We were looking for people who’d seen the future and could help us shape it.”

— Brian Chesky, Co-founder of Airbnb

When founders partner with the right VCs / accelerators or incubators, they unlock a network of resources that traditional financing can't offer.

🚀 Here’s what VC ecosystem brings to the table beyond capital:

Strategic Guidance

Top VCs have seen hundreds of companies scale. They advise on pricing models, hiring roadmaps and when to pivot.Access to Global Talent

Great talent follows strong VCs. Many VCs help build out founding teams, executive roles, and advisory boards.Go-to-Market Muscle

VCs often connect founders with distribution channels, enterprise customers, or media contacts that can change a company’s trajectory overnight.Board-Level Oversight

Most VCs sit on boards not to dictate but to guide helping startups avoid common mistakes, navigate funding cycles, or even manage crises.Emotional & Founder-First Support

The best VCs are trusted confidantes. When the stakes are high, and the founder’s world is crumbling, VCs often play therapist, mentor, and teammate.

“A great VC knows when to push, when to hold, and when to just listen.”

— Ann Miura-Ko, Co-founding Partner, Floodgate

This kind of partnership can mean the difference between burnout and a breakthrough, or shutdown and survival.

In short: Venture capital, when done right, is a support system for bold builders.

5. VC contributes to Economies and Jobs

While venture capital is often associated with unicorns and tech founders, its true impact ripples far beyond Silicon Valley boardrooms. VC-backed companies create jobs, new industries, and economic momentum. An insightful paper by Alexander Baker analyzes the role of VC in driving GDP expansion on a global scale.

Take this:

VC-backed firms generate millions of jobs. In fact, one study found that VC-backed companies in the U.S. are responsible for over 62 million jobs globally.

(Source: Stanford GSB research by Strebulaev & Gornall)

VC is about building the infrastructure of modern economies.

When Nvidia (initially VC-backed) powers AI innovation, it transforms industries from health to robotics.

When Zoom scales during a global pandemic, it changes how the world works and communicates.

When Moderna develops mRNA vaccines, it reshapes biotech and saves millions of lives.

“Venture capital is a long-term driver of national competitiveness.”

- National Venture Capital Association (NVCA)

In emerging economies too from Nairobi to Bengaluru, VC is laying the groundwork for financial inclusion, better healthcare, clean energy and new employment frontiers.

VC reflects belief breakthrough science, disruptive tech systemic transformation, and global impact.

I like these breakdowns to simple terms as an intro for a large audience, well put together!

Interesting read.